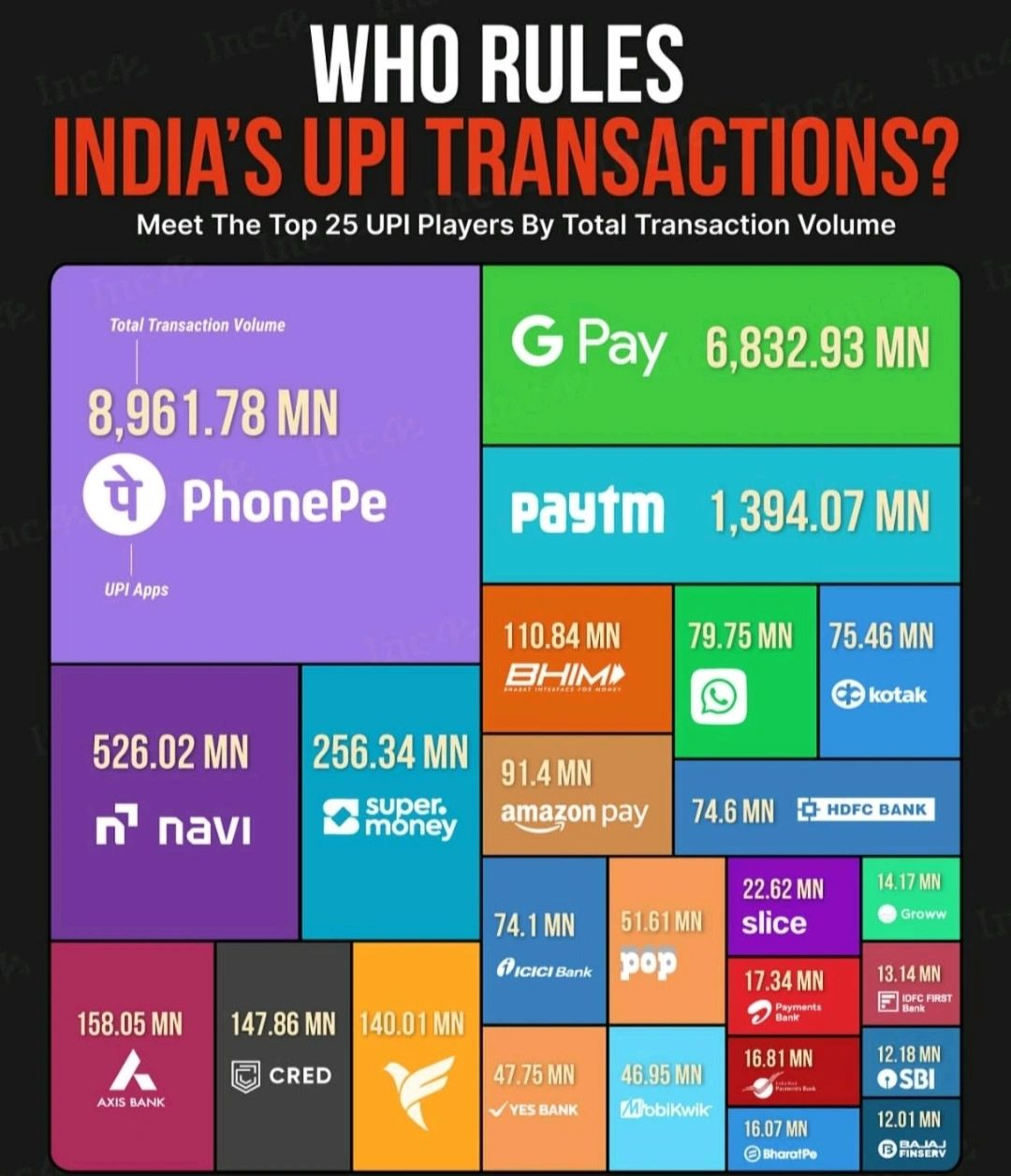

Who Rules India's UPI Transactions

At first glance, this chart looks like a healthy market. Twenty five players. Big logos. Different colors. It feels like competition is alive.

Then you read the numbers and reality hits hard.

PhonePe is at 8,961.78 million transactions. Google Pay is at 6,832.93 million. Paytm is at 1,394.07 million.

Together, these three apps process 17,188.78 million transactions out of 19,193.86 million from the top 25 shown in the chart. That is roughly 89.55 percent. So yes, almost 90 percent of UPI volume sits with just three apps.

The remaining twenty two players are sharing what is left. That is around 10.45 percent combined.

The Market Looks Wide but It Is Not Deep

The chart gives an illusion of choice, but usage tells a different story. This is not a balanced race. This is concentration.

After the top three, the numbers drop sharply. Navi is at 526.02 million. Super money is at 256.34 million. Axis Bank is at 158.05 million. CRED is at 147.86 million. Every app after the top three is fighting for a much smaller slice.

It is not just that PhonePe and Google Pay are ahead. They are in a different universe.

Why Only Three Keep Winning

UPI is simple in theory. Open app. Scan. Pay. Done.

In practice, this flow depends on trust and speed. If an app fails once during a busy moment, users remember. If an app asks for too many steps, users switch. If an app feels unstable on weak networks, users move on.

PhonePe and Google Pay win because they feel predictable. Paytm stays strong because it is deeply present in merchant journeys, recharge flows, and bill payments.

These apps are not just payment tools anymore. They are habits. And habits are very hard to break.

I Use SBI and It Is Honestly Exhausting

I use SBI because my primary account is there. So I have tried to stay loyal to its app for regular UPI payments.

But it is frustrating in daily use.

The experience often feels slow. The flow has too many screens for simple actions. Sessions can expire at the worst time. Sometimes the app feels one tap behind what you are trying to do.

And when all you want is to pay someone quickly at a store, every extra second feels painful.

In this chart, SBI sits at 12.18 million transactions. That is about 0.06 percent of the top 25 total shown here. PhonePe alone is around 736 times bigger by this chart.

That gap is not a branding problem. It is a product experience problem.

What This Means for Users and Smaller Apps

For users, concentration has a hidden cost. If everyone depends on the same three apps, outages become more stressful. Choices look available, but real alternatives feel weak.

For smaller apps and bank apps, the message is clear. Cashback campaigns are not enough. Fancy screens are not enough. Growth in UPI comes from reliability, speed, and trust in the exact moment people need to pay.

If the basics are weak, users will not stay.

Final Thought

India built one of the best payment rails in the world with UPI. That part is incredible.

But the app layer on top is becoming too concentrated. Right now, three apps own almost everything, and the rest are mostly spectators.

As a user, I just want one thing from every UPI app, especially from SBI. Make payments fast. Make it stable. Make it boring in the best way possible.

Because in payments, boring is what trust feels like.